Country received $2.523 billion in July 23rd

Although the country received $2.523 billion in July 23rd, FY23, compared to $2.736bn in July 22nd, FY22, the SBP reported, the country received a total of $31 billion in remittances last year.

During June of this year when compared to May, average remittance amount increased by 18.4%.

The SBP kept up the momentum of finances by recording an influx of $2.5 billion in remittance earnings, which continued their record streak of over $2 billion for 26 consecutive months.

The increasing trend of remittances continued in the FY22, while the new fiscal year started with a drop in remittances. There are many reasons for this, though.

While the US and Europe fared better, almost all other destinations in the world saw remittances from them decline.

The only place where there was an increase–and it was not even by a significant percent–was in the UK, with $4.58 billion received this year so far.

In July of this year, remittances decreased by 8.0% on a month-on-month basis and by 7.8% on a year-on-year basis due to less working days during Eid this July which shortened to 17 rather than 22 in June.

The banking authority pointed out that remittances decreased due to lower number of working days.

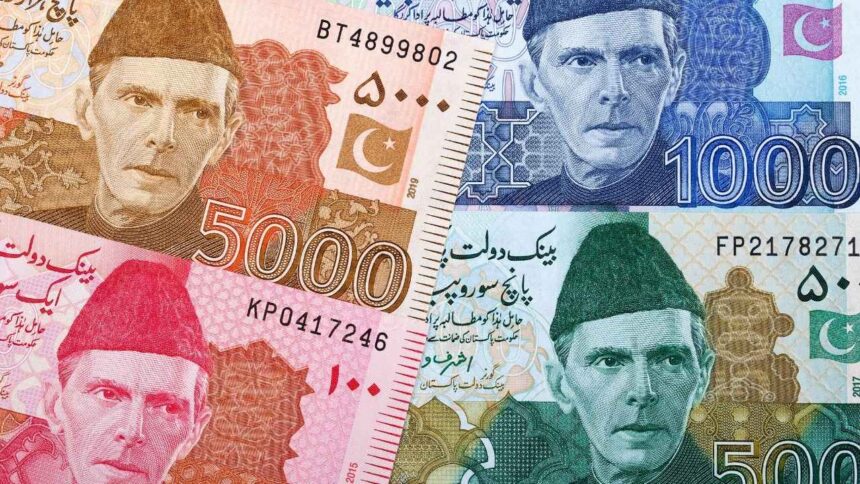

Pakistani economy

Pakistani economy relies on remittances from abroad; however, exports and imports have increased since FY 2014. The trade deficit has increased to $17.4 billion.

This large flow of remittances, about $31 billion in fiscal year 22, could not bridge the trade gap. Because countries don’t have enough foreign currency, they are unable to buy enough imported goods.

Efforts by the government managed this would result in decreased foreign debt and a balanced current account deficit on the external front of the economy.

The drop of about 48% in imports in July was not welcomed by the industry and the All Pakistan Textile Mills Association representative announced an expected decline of about $3 billion in textile exports in FY23.

As of late, the government has been working hard to get the IMF loan back. This is a condition for the IMF to get an approval at the upcoming member meeting in the last week of August.

The finance minister announced recently that $4 billion was on hand.

Saudi remittances

Saudi remittances were $580.6 million this July, less than the same month in FY22 by 12 percent. Saudi Arabia is looking to keep $3 billion in the SBP’s account to support Saudi Arabia’s dwindling foreign exchange reserves.

The Kingdom has been known to provide monetary support in the past.

The second highest inflow of remittances was from the United Arab Emirates, which was about $456 million but it also fell by 16.7 percent compared to the same month of last fiscal year.

Despite the economic risk, the UK is not on top of the list when it comes to receiving remittances.

July was the fourth month in which Europe saw $294 million in remittances that came out of different countries. as compared to last year, there was a 2.2% decline.

Other key sources of remittances were $254 million from the United States of America and $280.6 million from other Gulf Cooperation Council countries.